Financial Summary

The Foundation’s investment portfolio ended in 2019 at approximately $602 million, representing a net increase of $66 million after disbursement for grants, administrative expenses and taxes totaling $27 million during the year. 2019 turned out to be a strong year for both equity and bond markets. Despite the persistence of ongoing macro risks, global equity markets posted their best year since the aftermath of the financial crisis a decade ago and U.S. equities ended the year near all-time highs. To that end, the portfolio delivered a strong return of 17.6 percent after fees in 2019, marking its best annual gain since 2003.

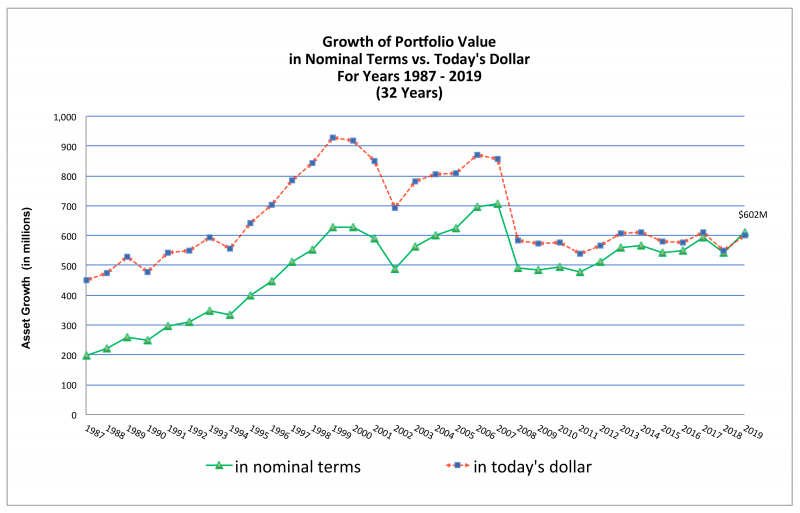

The Foundation’s investment objective continues to be securing maximum long-term total return on its investment portfolio in order to maintain a strong grants program, while assuring consistent growth of its assets at a level greater than the rate of inflation. We are pleased that the Foundation was able to preserve and enhance the real value of its endowment over the past 32 years; the portfolio appreciated from $198 million (nominal value) or $441 million (in today’s dollar) at the end of 1987 to $602 million at the end of 2019, while spending over $1 billion in today’s dollars for grants and expenses during this period of time.

In an effort to align the Foundation’s investments with its philanthropic mission or program initiatives, the investment policy statement was revised during 2019. The amendment will allow the Foundation to seek mission-aligned investment opportunities as well as incorporate environmental, social and governance (ESG) criteria into the portfolio.

With the assistance of Goldman Sachs, the Foundation’s investment advisor since August 2012, the Foundation has proactively redesigned its asset allocation guidelines while maintaining a moderate plus risk portfolio diversified across a wide array of asset classes and strategies. The portfolio has experienced significant asset allocation changes since 2012. There has been a noticeable transition of assets from alternative investments (hedge funds and private assets) into traditional asset classes (long-only equity and fixed-income) during this period.

Heading into 2020, considerable uncertainty around the impact of the continuing spread of the coronavirus, upcoming domestic elections, potentially volatile geopolitical situations and ongoing trade tensions may lead to economic and market dislocations. With a keen focus on the risks and financial market volatility, Goldman will continue to reevaluate the portfolio’s strategic asset allocation in order to ensure that the portfolio can withstand dramatic swings in the financial markets. While 2020 is off to a challenging start, we are confident that our disciplined, prudent investment approach coupled with robust diversification will provide us with the ability to navigate an unpredictable political and economic landscape while pursuing investment opportunities.

The Finance Committee and the Board of Trustees meet regularly with Goldman Sachs to review asset allocation, investment strategy and the performance of the underlying investments. Northern Trust Corporation is the custodian for all the Foundation’s securities. A complete listing of investments is available for review at the Foundation’s offices. Audited financial statements were not completed in time for this publishing but will be available on the Foundation’s website in June.

Eva Cheng

Vice President, Finance